In this day and age it seems surprising that it can take a bank WEEKS to approve a loan application, why is that?

The unfortunate reality is the banks home loan process is very manual.

Once your loan has been submitted to the bank, it sits in a queue waiting for a human assessor to look at your payslips, review your bank statements and recommend approval.

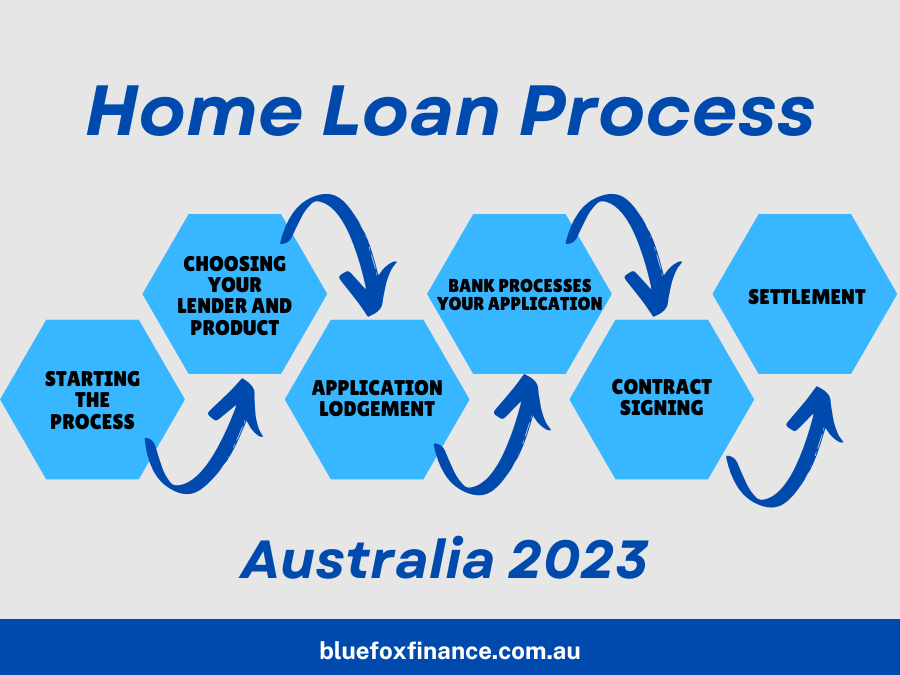

Let's step through the bank's internal process so you understand the steps involved.

- Hunter Galloway: We submit your application form, payslips, bank statements, contract of sale and other information via a secure electronic platform to the banks for assessment.

- Bank + 6 hours: The bank confirms via an automated email that they have received the application and it is in a queue waiting for a human to double check the payslips, and bank statements have also been received.

- Hunter Galloway: We will check in with the bank to make sure they have received the information at 24 hour point.

- Bank + 2 Days: A human 'pre assessor' reviews the information we provided just to check (1) the application form has been signed correctly, (2) we included your payslips (3) there are no basic bits of information missing.

- If all good, they pass the application onto the next queue for assessment.

- If there is information missing they refer the application back to us to resolve.

- Hunter Galloway: We'll call the bank to confirm everything is progressing and try to get an update on timeframes as these can sometimes slip.

- Bank + 3-7 Days: A human assessor will pick up the application when it reaches the front of their queue.

- They will review the loan notes we provided on your situation, confirm the payslips match the numbers we have input in the application form, and review your bank statements manually to see there is no bad conduct or gambling. Due to the manual nature of this process, it can take the assessor several hours to complete.

- If there is missing information, or they need to clarify something they will call us to find out what the situation is - OR they will email a request for the missing information.

- If everything is held, they will recommend the application is approved and then refer the application to a Credit Manager, or Lenders Mortgage Insurer for sign off.

- Bank + 1-2 Days: A Credit Manager, or person at the Lenders Mortgage Insurance company will again complete a manual review of the information provided.

- If there is missing information, or they need to clarify something they will refer the application back to the banks Human Assessor to clarify. This can take 1-2 days to happen, at which point they will contact Hunter Galloway to clarify.

- Otherwise if everything is held, they will approve the application and refer back to the human assessor to complete the approval procedure.

- Bank + 1 day: Human assessor will receive confirmation of approval from Senior Credit Manager, or Lenders Mortgage Insurer. They will issue the approval letter to Hunter Galloway.

- Hunter Galloway: We will get in touch and congratulate you on the approval!